san fran sales tax rate

A good sale tofrom Savannah. The minimum combined sales tax rate for San Francisco California is 85.

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

There is no applicable city tax.

. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025. California City and County Sales and Use Tax Rates Rates Effective 04012017 through 06302017 1 P a g e Note. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their.

The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375. California CA Sales Tax Rates by City S The state sales tax rate in California is 7250. San Francisco County Sales Tax Rates for 2022.

This is the total of state county and city sales tax rates. San Francisco has parts of it located within. 2020 rates included for use while preparing your income tax.

This rate includes any state county city and local sales taxes. The latest sales tax rate for San Francisco CA. Pricing will vary slightly depending on routingThis is a regular economy fare with advance seat assignment and normal size carry-on includedSa.

This is the total of state county and city sales. District tax areas consist of both counties and cities. The 85 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 225 Special tax.

A base sales and use tax rate of 725 percent is applied statewide. The average cumulative sales tax rate in San Francisco California is 864. 0875 lower than the maximum sales tax in CA.

San Francisco County in California has a tax rate of 85 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates. The minimum combined 2022 sales tax rate for South San Francisco California is. This includes the rates on the state county city and special levels.

There may also be more than one district tax in effect in a specific location. The South San Francisco California sales tax is 750 the same as the California state sales tax. The California sales tax rate is currently 6.

The minimum combined sales tax rate for San Francisco California is 85. Payroll Expense Tax. This is the total of state county and city sales tax rates.

2020 rates included for use while preparing your income tax. San Francisco County California Sales Tax Rate 2022 Up to 9875. The latest sales tax rate for South San Francisco CA.

This rate includes any state county city and local sales taxes. The latest sales tax rate for San Francisco County CA. In addition to the statewide sales and use tax rate some cities and counties have voter- or local government-approved district taxes.

With local taxes the total sales tax rate is between 7250 and 10750. This rate includes any state county city and local sales taxes. How much is sales tax in San Francisco.

A county-wide sales tax rate of 025 is applicable to localities in San Francisco County in addition to the 6 California. Please visit our State of Emergency Tax Relief page for. While many other states allow counties and other localities to collect a local option sales tax.

The California sales tax rate is currently 6. What is the sales tax rate in South San Francisco California. This is the total of state county and city sales tax rates.

2020 rates included for use while preparing your income tax. Next to city indicates incorporated. The minimum combined sales tax rate for San Francisco California is 85.

1788 rows Businesses impacted by recent California fires may qualify for extensions tax relief and more.

Understanding California S Sales Tax

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

The Pros And Cons Of Locating Your Business In San Francisco

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

How To Legally Avoid Car Sales Tax By Matthew Cheung Medium

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

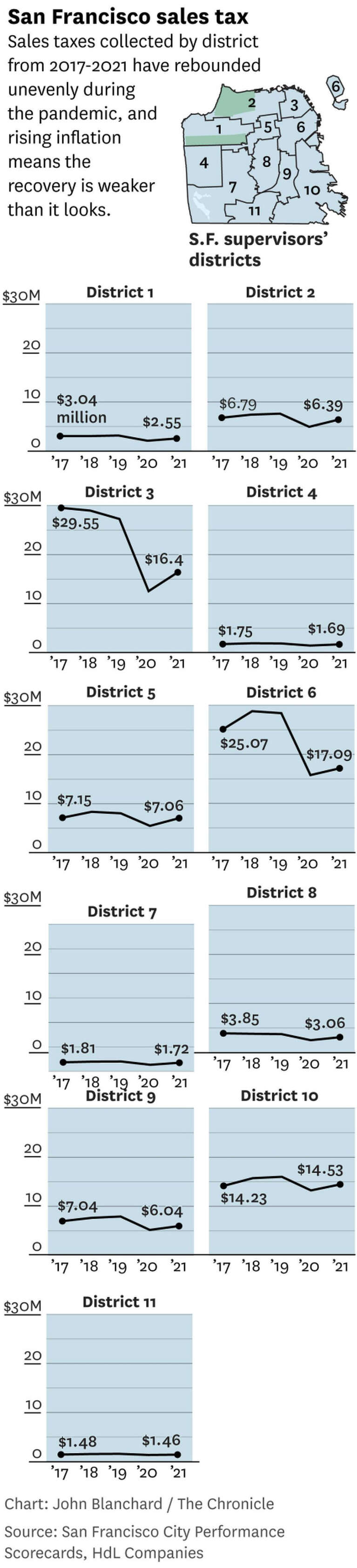

Downtown Vs Neighborhoods S F Sales Tax Data Shows Where People Are Spending Their Money

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

Sales Tax Collections City Performance Scorecards

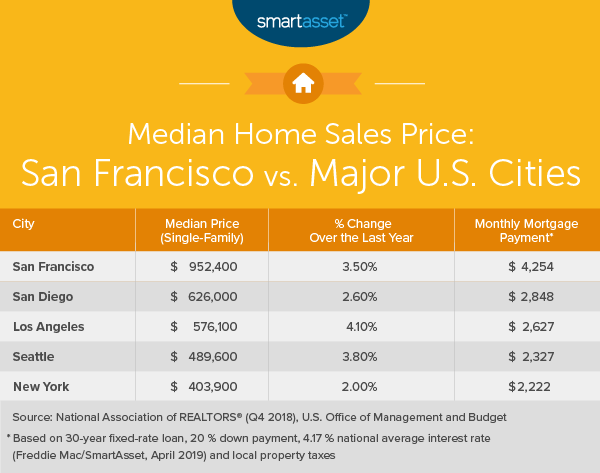

What Is The True Cost Of Living In San Francisco Smartasset

California Sales Tax Rates By City County 2022

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

Understanding California S Sales Tax

California Sales Tax Rate By County R Bayarea

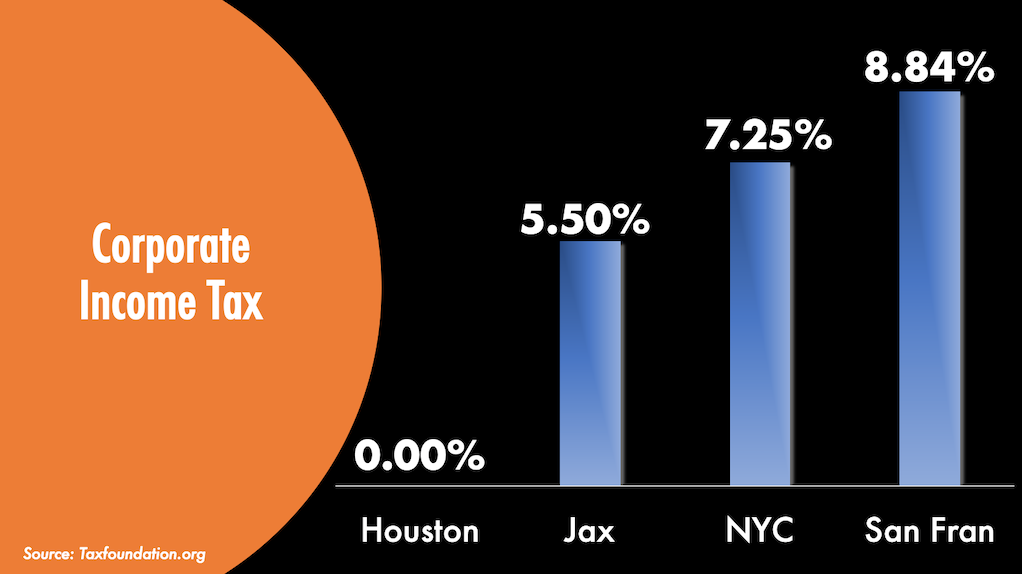

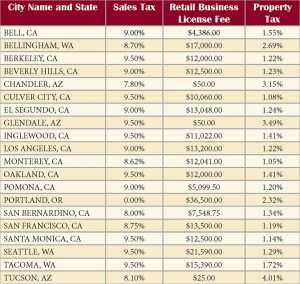

California Cities Among Most Expensive In West To Do Business Advocacy California Chamber Of Commerce

San Francisco Prop W Transfer Tax Spur

Why Households Need 300 000 To Live A Middle Class Lifestyle

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia